Tax Benefits of Using Coworking Spaces in 2024

Discover the remarkable tax benefits associated with coworking spaces that can greatly impact your tax returns. If you’re a start-up, entrepreneur, freelancer, sales representative, real estate agent, business founder/owner, or remote worker, you’ll be delighted to learn that coworking expenses can often be written off as deductions.

As an independent contractor, such as a 1099 employee or freelancer, you have the opportunity to deduct coworking memberships as legitimate business expenses when filing your taxes. However, W2 employees are ineligible for this deduction, as business expenses cannot be claimed.

According to the Freelancers Union Blog, opting for a monthly coworking space provides a hassle-free and 100% tax-deductible solution to claim an office space, eliminating the need for complex calculations about the value of your apartment’s three square feet dedicated to work. Say goodbye to the tedious process of measuring your home office and filling out endless forms. With benefits like these, leveraging a coworking space like The Works – Gilbert becomes an invaluable advantage.

Maximizing Tax Benefits: How Coworking Spaces Can Help Your Bottom Line

In today’s dynamic work environment, coworking spaces have become a popular choice for professionals seeking flexibility and collaborative opportunities. Beyond the obvious advantages, there’s another compelling reason to embrace coworking: the potential tax benefits.

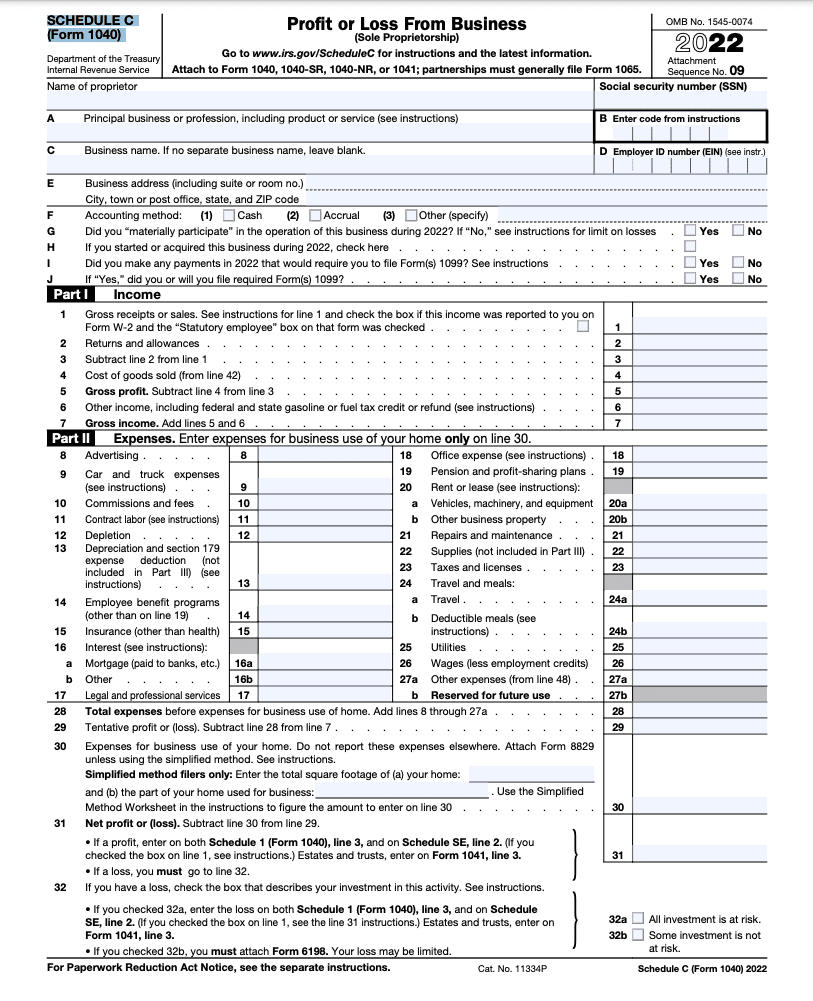

One key aspect highlighted by 1800accountant.com is that if you use a coworking space as your primary office, you can include the cost as an unreimbursed employee expense on Schedule A of Form 1040. This is particularly relevant for remote workers who frequent coworking spaces. To fully benefit from this deduction, ensure that you obtain reimbursement from your employer and accurately document your expenses.

According to 1800accountant.com details the Tax Benefits of using coworking Spaces, “If you use a co-working space as your office you can you can include the cost as an unreimbursed employee expense on Schedule A of Form 1040″ If you are a remote worker and utilize a co-working space make sure you get reimbursed from your employer and write it off on your taxes. Turbo Tax says that you may use the IRS’ two percent rule which states that you may claim the number of your expenses that exceeds two percent of your adjusted gross income.

To calculate your deductible expenses, TurboTax suggests referring to the IRS’ two percent rule. According to this rule, you can claim the amount that exceeds two percent of your adjusted gross income. By keeping track of your coworking expenses, such as membership fees, conference room rentals, printing costs, or participation in professional development activities like yoga classes, you can maximize your eligible deductions. However, remember that expenses related to commuting or personal meals are not eligible for write-offs.

As members of The Works, you have access to various amenities and services, including the convenience of invoice and receipt printing. If you require physical copies of your invoices or receipts from The Works – Gilbert, simply email hello@theworksgilbert.com, and our team will gladly assist you. We are committed to supporting your business growth in every possible way.

In conclusion, embracing shared workspaces not only fosters collaboration and flexibility but can also deliver tax benefits of using coworking spaces. By following the recommended strategies, documenting your expenses diligently, and consulting with a qualified accountant, you can optimize your tax planning and elevate your financial success. Choose coworking as the foundation for your business and reap the rewards it brings.

Don’t take our word for it – hear about the Tax Benefits of using Coworking Spaces (from local pros)

While The Works team is not composed of tax professionals, we understand the value of reliable CPA recommendations. Conveniently, some of our members are certified public accountants themselves. Feel free to reach out to us for a trusted CPA referral to ensure you receive expert guidance tailored to your specific tax needs.The team at The Works isn’t tax professionals, so we recommend getting in touch for a CPA. And when it comes to CPAs, we have members who are CPA’s. How convenient is that? Feel free to reach out for a recommendation.

Understanding IRS Rules for Tax Deductibility of Coworking Spaces

As the popularity of coworking spaces continues to rise, it’s crucial to grasp the IRS rules regarding their tax deductibility. Whether you’re a freelancer, self-employed professional, or remote worker, knowing how these rules apply can significantly impact your tax planning. Let’s delve into the key considerations.

The IRS considers coworking expenses deductible if they meet certain criteria

-

- To qualify, the coworking space must be necessary for your business operations and used exclusively for business purposes. If you meet these conditions, you can claim the expenses as either unreimbursed employee expenses (if you’re an employee) or as business expenses (if you’re self-employed).

- For employees, coworking expenses fall under the category of unreimbursed employee expenses, which are claimed on Schedule A as miscellaneous deductions subject to a two percent floor.

- However, it’s essential to note that unreimbursed employee expenses, including coworking expenses, are no longer deductible for tax years 2018 through 2025 due to changes in tax laws brought by the Tax Cuts and Jobs Act.

- On the other hand, self-employed individuals can deduct coworking expenses as legitimate business expenses. These deductions can be claimed on Schedule C (Form 1040) or Schedule F (Form 1040) for farmers.

To ensure compliance with IRS rules, it’s crucial to maintain accurate records of your coworking expenses. Keep track of membership fees, rental costs, and any additional expenses directly related to your business activities within the coworking space. Proper documentation is essential to substantiate your deductions in case of an audit.

It’s worth noting that tax laws are subject to change, so staying updated with the latest IRS guidelines and consulting a qualified tax professional is highly recommended. They can provide personalized advice tailored to your specific situation and help you navigate the intricacies of tax deductibility for coworking spaces.

In conclusion, understanding the IRS rules regarding coworking spaces and tax deductibility is vital for maximizing your tax benefits. By meeting the necessary criteria, maintaining accurate records, and seeking professional guidance, you can ensure compliance while taking advantage of available deductions. Stay informed, stay organized, and make the most of the tax benefits offered by coworking spaces.